Lasting Power of Attorney

Home // Lasting Power of Attorney

What is a Lasting Power of Attorney?

A Lasting Power of Attorney (LPA) is a legal document that allows you to appoint one or more people to help you make decisions or to make decisions on your behalf if you ever have an accident or illness and can no longer make decisions for yourself. This gives you more control over what happens if something unexpected happens.

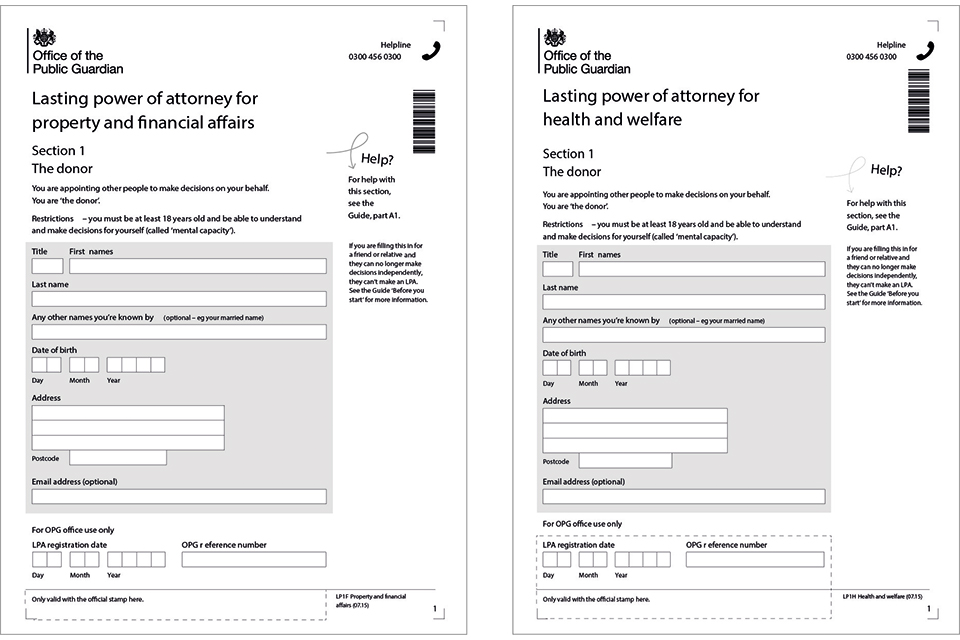

Health and Welfare

A health and welfare lasting power of attorney is a document that allows someone else to make decisions for you about things like your daily routine, medical care, or moving into a care home. This only happens if you are not able to make these decisions yourself.

Property and Financial affairs

A property and financial affairs lasting power of attorney can be used to give someone the power to make decisions about your money and property. This includes things like managing a bank account, paying bills, collecting benefits or a pension, or selling your home. The power can be used as soon as it is registered, with your permission, and also when you no longer have mental capacity.

Why have a Lasting

Power of Attorney?

How we can help you...

For peace of mind – you will know who will deal with your financial affairs if you are unable to do it yourself (temporarily or permanently).

To save money – a small initial outlay now can save time, trouble and expense, and avoid the cost of a Court of Protection Deputyship in the event of mental incapacity.

To simplify the administration of your affairs for your family and friends in the event of your mental incapacity. Your Attorney will be able to deal with your affairs without the difficulties encountered where there is no legal authority

To be prepared. No one can foresee the future; mental incapacity can occur unexpectedly e.g. following an accident or stroke. Illness may result in physical incapacity or hospitalisation. Bills still have to be paid, a business needs to be run, and arrangements may need to be made to sell a house and organise nursing or residential care.

Setting up a Lasting

Power of Attorney

Frequently Asked Questions

If you want someone to be able to act on your behalf if you can’t make decisions for yourself, then you should consider creating a lasting power of attorney. An ordinary power of attorney is valid only as long as you’re mentally capable of making decisions on your own.

In a Lasting Power of Attorney (LPA) you appoint one or more people (known as ‘attorneys’) to help you make decisions or to make decisions on your behalf.

This gives you more control over what happens to you if you have an accident or an illness and cannot make your own decisions (you “lack mental capacity”).

There are many situations in life when you may need someone to make decisions for you. These could be either in the short-term, such as during a brief hospital admission, or in contemplation of the effects of a long-term diagnosis, such as dementia.

Making an LPA enables you to make provision for any eventuality in which you may need someone to make decisions on your behalf.

Remember – you can only grant someone an LPA while you have the mental capacity to do so. Should you lose capacity in the future, you will not then be able to grant the power. Your family will need to apply to the Court of Protection to obtain the power to control your finances. This can be a longer and more expensive route.

Anyone over the age of 18 can act as an attorney (with the exception of paid care workers). An attorney could be a family member, friend, spouse or civil partner, or even a professional such as a solicitor.

An LPA gives a lot of responsibilities to the attorney and they must act in your best interests. As the attorney has the power to make many important decisions on your behalf, it is important that you take time to carefully consider who you feel would be able to carry out this role and who you trust to act in your best interests.

This may be quite obvious and logical to most people. However, when acting on your behalf if you ever do lose mental capacity, an attorney must consider your individual circumstances and continue to encourage you to participate in the decision-making process, whenever they can. Additionally, the attorney must take into consideration their knowledge of your beliefs and values and your past and present feelings. They must also consult with your family members, friends or those involved in your care, to obtain a wider view of your views and feelings, to better inform them as to what may be in your best interests.

In simple terms, mental capacity means the ability to make a decision in relation to a specific issue.

The Mental Capacity Act 2005 (“the Act”) states a person is deemed to lack capacity if:

- They have an impairment or disturbance in the functioning of their mind or brain; and

- That impairment or disturbance renders them unable to make a decision about a specific issue at the time it needs to be made.

The issue of capacity is decision and time specific and does not merely extend to that person’s ability to make decisions generally. A person may therefore lack the capacity to make a decision about certain issues but not others.

Requirements for a valid LPA

For a Lasting Power of Attorney to be legal it must:

- Be created when the donor has capacity.

- Be in writing and in the prescribed form.

- Include information about the nature and effect of the LPA.

- Be signed by the donor to demonstrate their intent for it to apply when they no longer have capacity.

- Be signed by the attorney(s) to demonstrate they understand their duties, particularly to act in the donor’s best interests.

- Include a certificate provided by a third party who can confirm the donor has capacity at the time the LPA is signed and to ensure that the donor is not being unduly influenced to make an LPA.

- Be registered with the Office of the Public Guardian before the attorney(s) can act.

Our Main Services

Lasting Powers of Attorney

£325

Lasting Power of Attorney Property & Financial Affairs – £325

Lasting Power of Attorney for Health & Welfare decisions – £325

Both Personal Lasting Power of Attorney for one person – £500

Both Personal Lasting Power of Attorney for a couple – £950

Office of Public Guardian Registration Fee, £82 per document

We also offer Trusts and Estate Planning, Please contact

We at Bicester Wills and Probate can offer expert advice and guidance in all of the above areas and more.